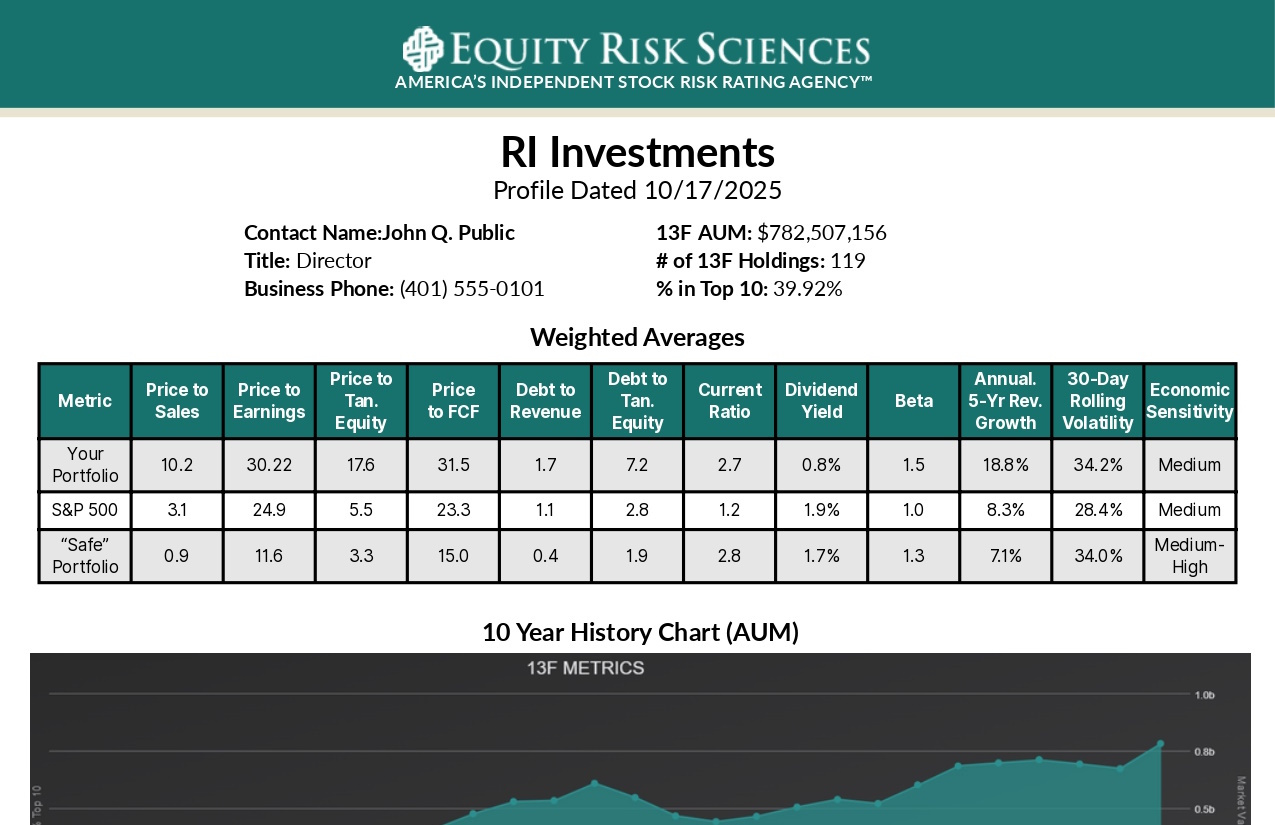

RI Investments

Excerpt from Form ADV Part 2, Item 8 –

Methods of Analysis, Investment Strategies and Risk of Loss

“We base our investment policy and portfolio construction on many factors. One important factor is that we seek investments when they represent value, as measured by price to earnings ratios (P/E), price to sales ratios (P/S), and others. […] At times, shares of fundamentally strong companies may have stock prices that sell for less than intrinsic value. This may represent an opportunity for a patient long-term investor. It is our belief that the greatest potential for investment success comes from holding an investment for 3, 5, 7 years or longer and not focusing on the short-term.” […]

“We attempt to minimize some of that risk of loss through diversification. We therefore diversify equity investments in numerous ways: by market sectors and industries, by corporate capitalization, by interest rate sensitivity, by economic cycles, and by industry strength, among others.” […]

“As part of our own primary research, we employ numerous analytical tools, including fundamental and technical analysis, market sentiment analysis and quantitative analysis when selecting investments for client accounts. Our investment team has over 92 years of combined investment experience.

“At times, certain industry sectors may be under-weighted or omitted due to risk or valuation. Other industry sectors may be over-weighted because of potential opportunities.”