A growth-oriented portfolio targeting smaller companies (market caps under $1 billion) that meet ERS’s stringent criteria for quality and value. Currently holds 11 positions at 2% each, with capacity for up to 50 stocks as additional opportunities are identified. Remaining capital is held in Treasury instruments, providing both downside protection and dry powder for opportunistic additions. Exceptional opportunities may receive 4% allocations.

This tactical approach acknowledges that compelling small-cap opportunities appear episodically rather than continuously. Monthly updates add new positions only when they meet established standards. Higher volatility potential than large-cap strategies.

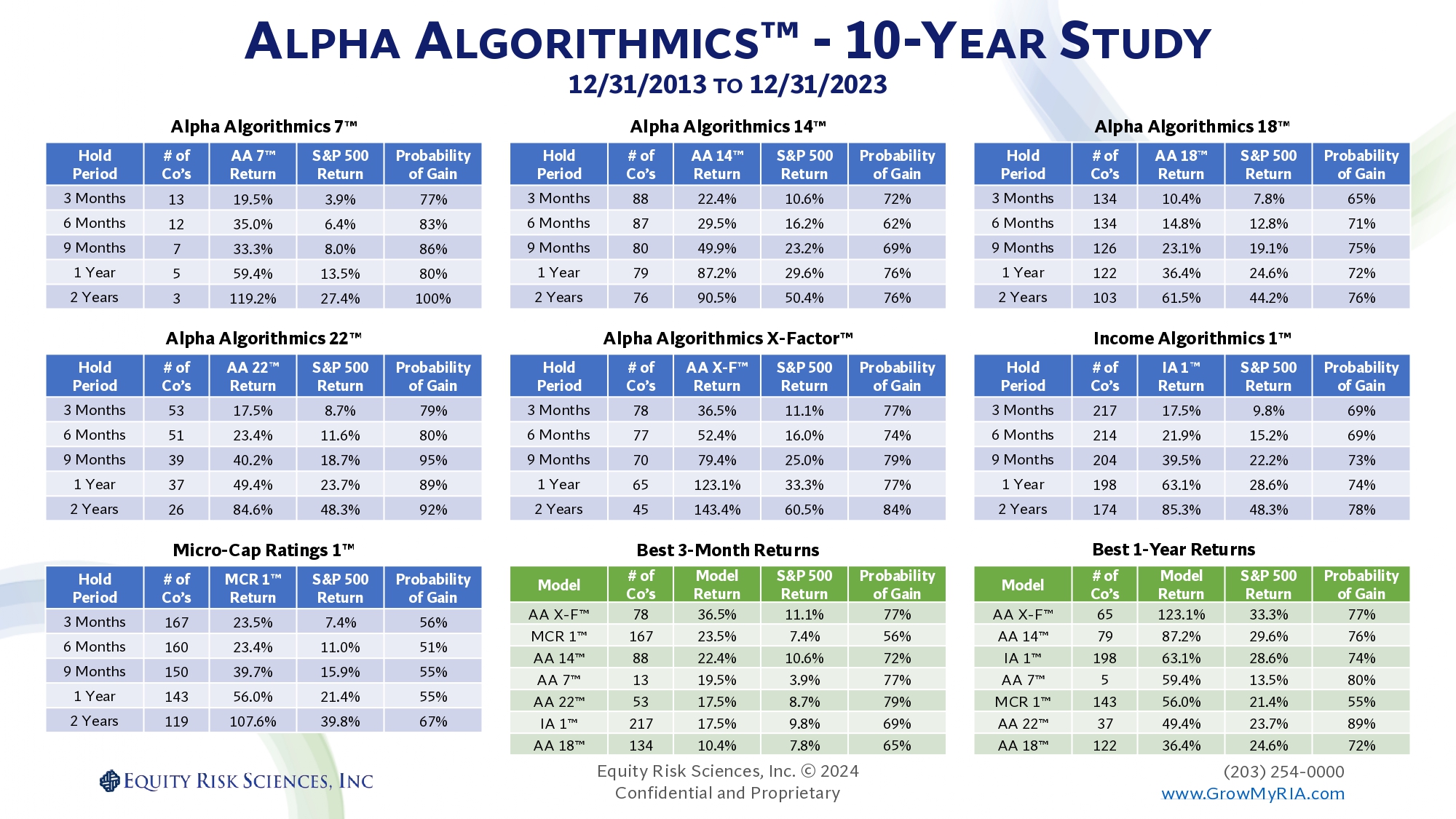

Historical Model Performance

Model performance data from predecessor strategy using ERS rating methodology.

Current portfolio incorporates refined criteria.

Click image to view full performance details

Model Performance Disclosure: The historical performance shown represents hypothetical model performance from a predecessor strategy utilizing ERS’s quantitative rating system. The current portfolio methodology incorporates refined selection criteria and implementation designed to improve risk-adjusted returns. While we expect comparable or superior performance, the specific portfolio structure described above has not yet generated model performance results. Hypothetical model performance has inherent limitations: it does not reflect actual trading, market impact, liquidity constraints, or fees. Past model performance does not guarantee future results.