A foundation portfolio of 40 diversified stocks selected through ERS’s proprietary risk rating system. Each position represents 2.5% of the portfolio, creating balanced exposure across companies demonstrating strong fundamentals and favorable risk-return profiles.

The portfolio is rebalanced monthly as ratings change, systematically removing holdings that no longer meet criteria and adding new opportunities. Designed for investors seeking consistent exposure to companies with attractive valuations relative to underlying business quality and financial strength.

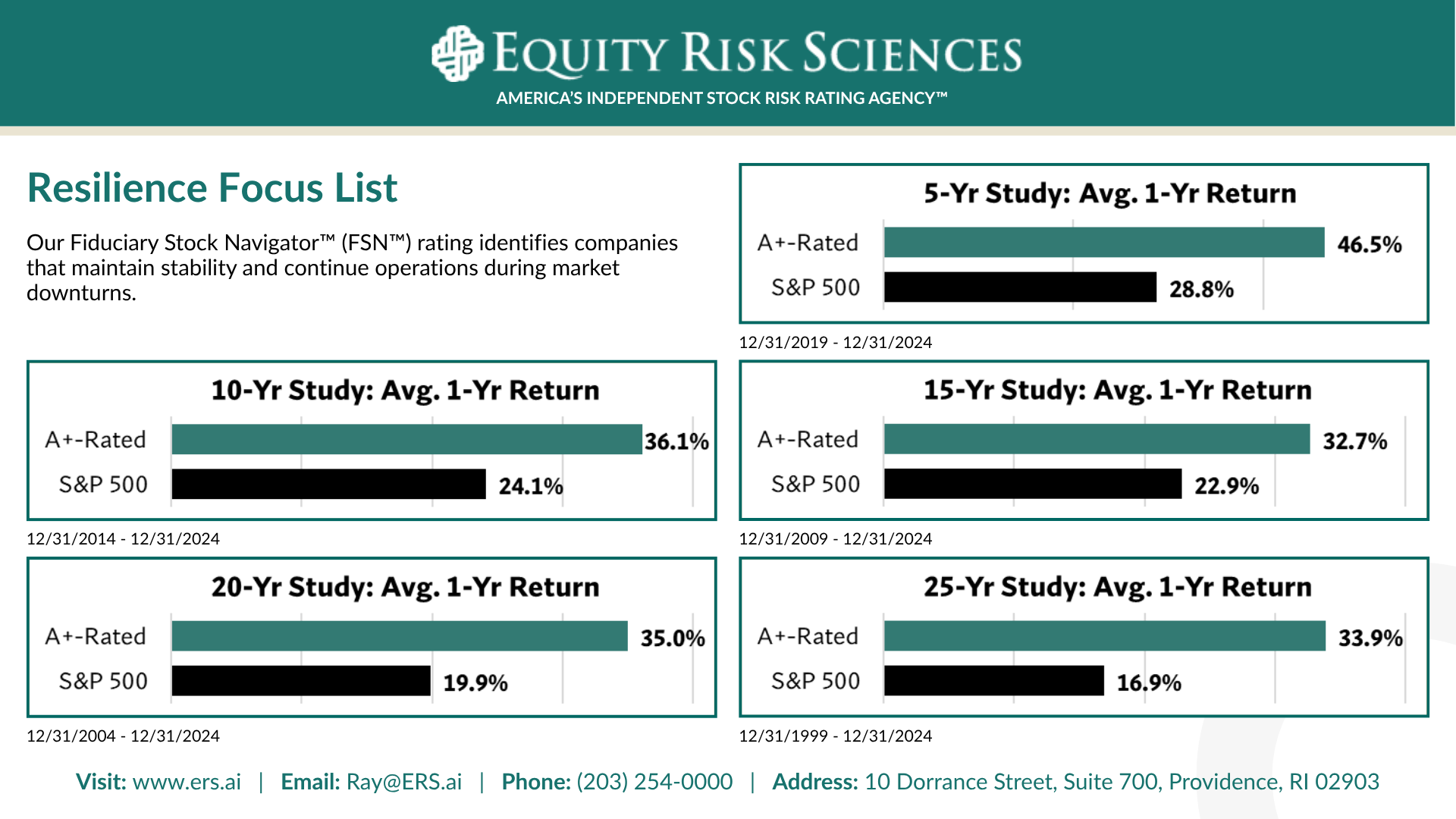

Historical Model Performance

Model performance data from predecessor strategy using ERS rating methodology.

Current portfolio incorporates refined criteria.

Click image to view full performance details

Model Performance Disclosure: The historical performance shown represents hypothetical model performance from a predecessor strategy utilizing ERS’s quantitative rating system. The current portfolio methodology incorporates refined selection criteria and implementation designed to improve risk-adjusted returns. While we expect comparable or superior performance, the specific portfolio structure described above has not yet generated model performance results. Hypothetical model performance has inherent limitations: it does not reflect actual trading, market impact, liquidity constraints, or fees. Past model performance does not guarantee future results.