A 25-stock portfolio focused on dividend-paying companies, deploying capital in two stages. Initial positions are 2% each, with remaining capital held in interest-bearing short-term instruments. The second 2% is invested only when individual holdings meet additional criteria for value improvement or risk reduction.

This approach reduces initial market exposure while preserving the ability to increase positions opportunistically. Designed for conservative income-focused investors who value both current yield and protection against market volatility.

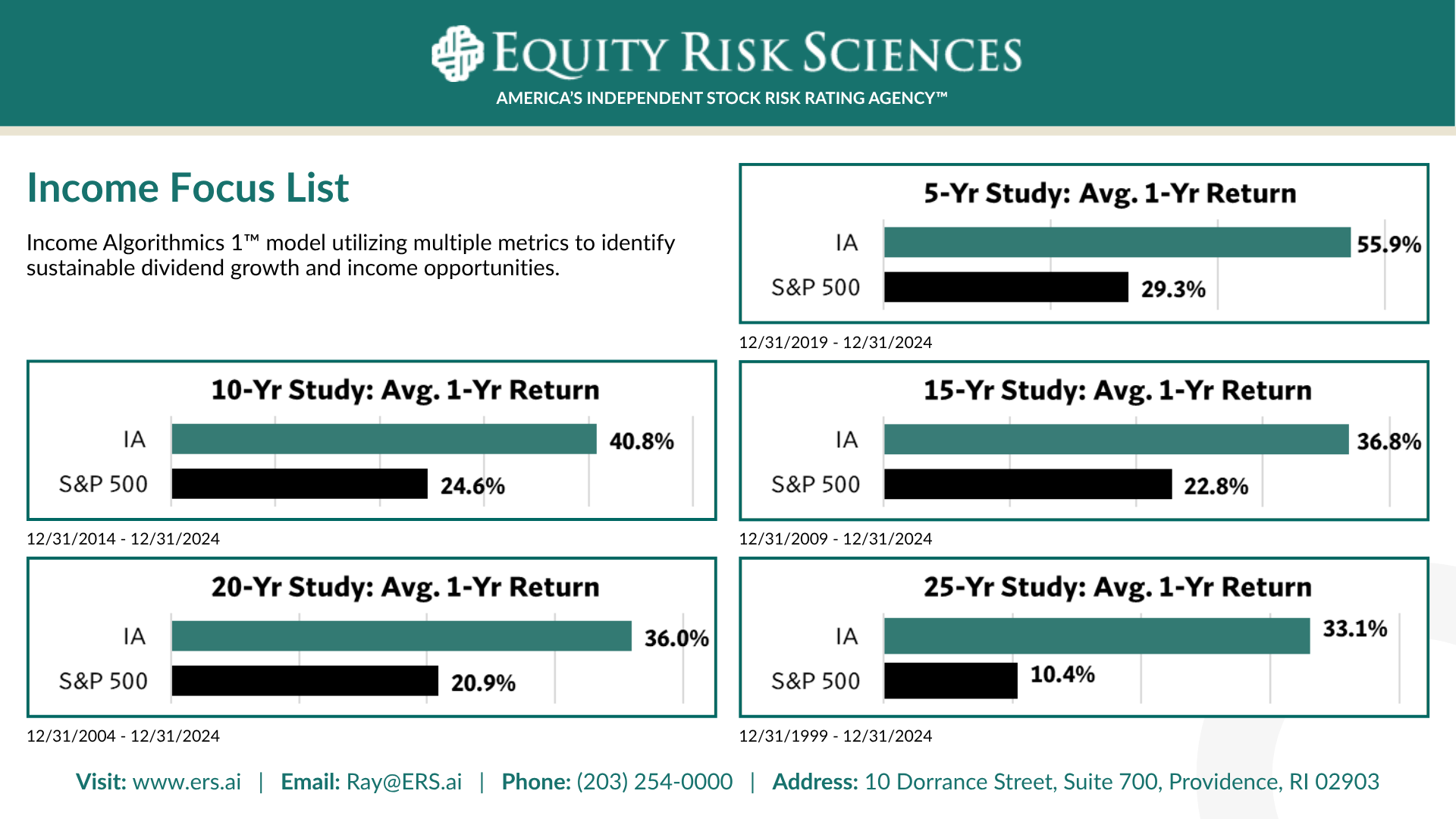

Historical Model Performance

Model performance data from predecessor strategy using ERS rating methodology.

Current portfolio incorporates refined criteria.

Click image to view full performance details

Model Performance Disclosure: The historical performance shown represents hypothetical model performance from a predecessor strategy utilizing ERS’s quantitative rating system. The current portfolio methodology incorporates refined selection criteria and implementation designed to improve risk-adjusted returns. While we expect comparable or superior performance, the specific portfolio structure described above has not yet generated model performance results. Hypothetical model performance has inherent limitations: it does not reflect actual trading, market impact, liquidity constraints, or fees. Past model performance does not guarantee future results.