A 25-stock portfolio focused on dividend-paying companies, with each position representing 4% of assets. Current portfolio yield averages 3.9% as of December 31, 2025. Stocks are selected using a proprietary risk assessment framework, but filtered specifically for companies with established dividend policies and the financial strength to sustain them.

Monthly rebalancing ensures the portfolio reflects current income opportunities while maintaining risk discipline. Suitable for investors prioritizing current income alongside capital appreciation potential.

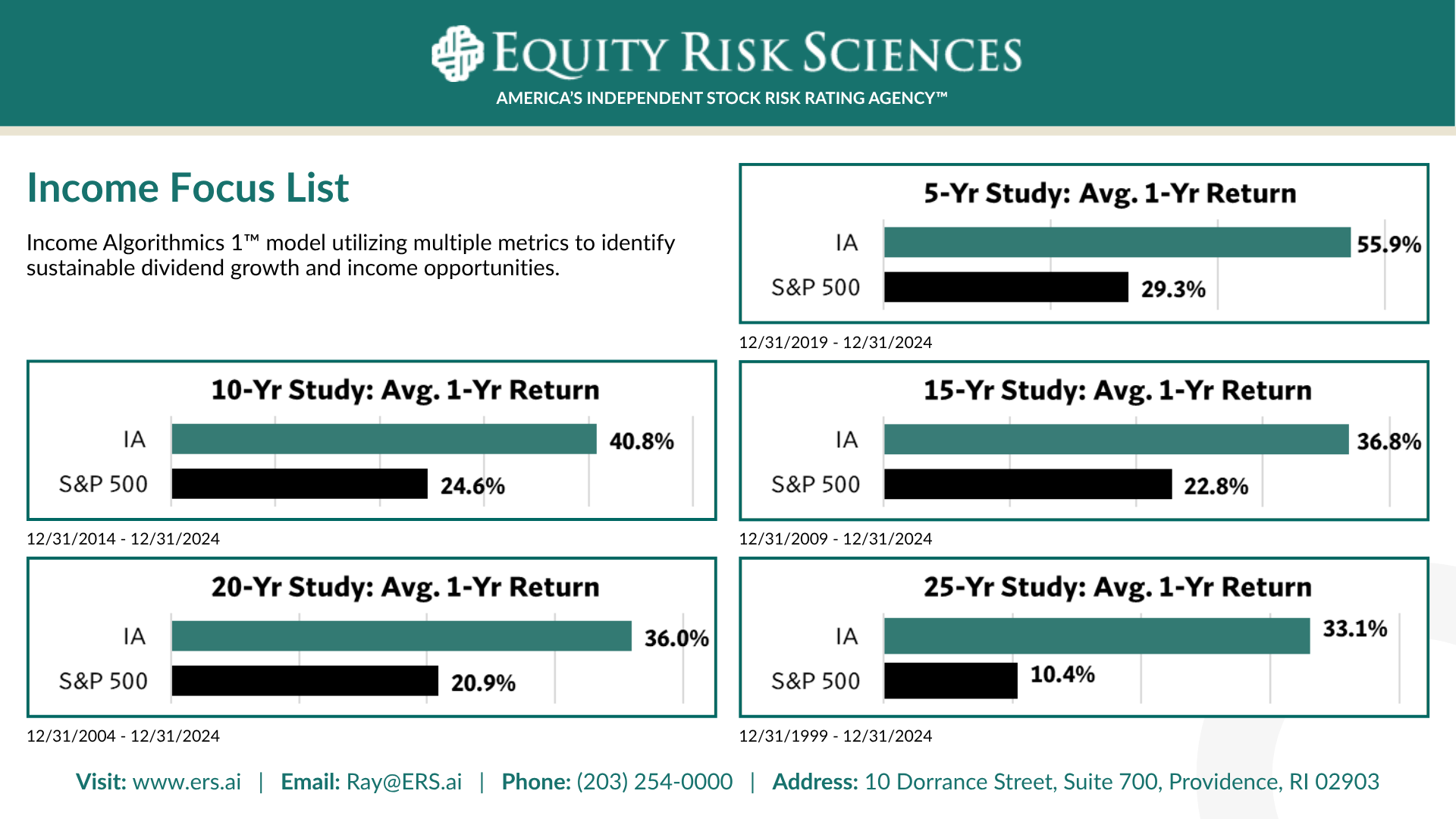

Historical Model Performance

Model performance data from predecessor strategy using ERS rating methodology.

Current portfolio incorporates refined criteria.

Click image to view full performance details

Model Performance Disclosure: The historical performance shown represents hypothetical model performance from a predecessor strategy utilizing ERS’s quantitative rating system. The current portfolio methodology incorporates refined selection criteria and implementation designed to improve risk-adjusted returns. While we expect comparable or superior performance, the specific portfolio structure described above has not yet generated model performance results. Hypothetical model performance has inherent limitations: it does not reflect actual trading, market impact, liquidity constraints, or fees. Past model performance does not guarantee future results.