Event Summary

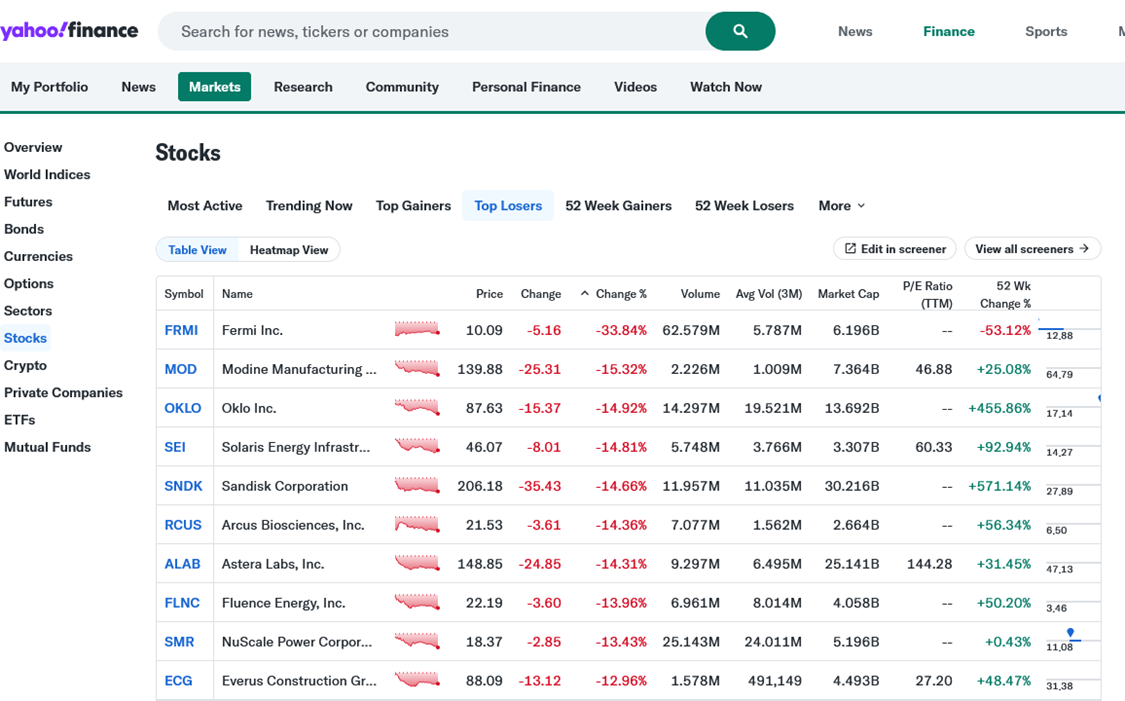

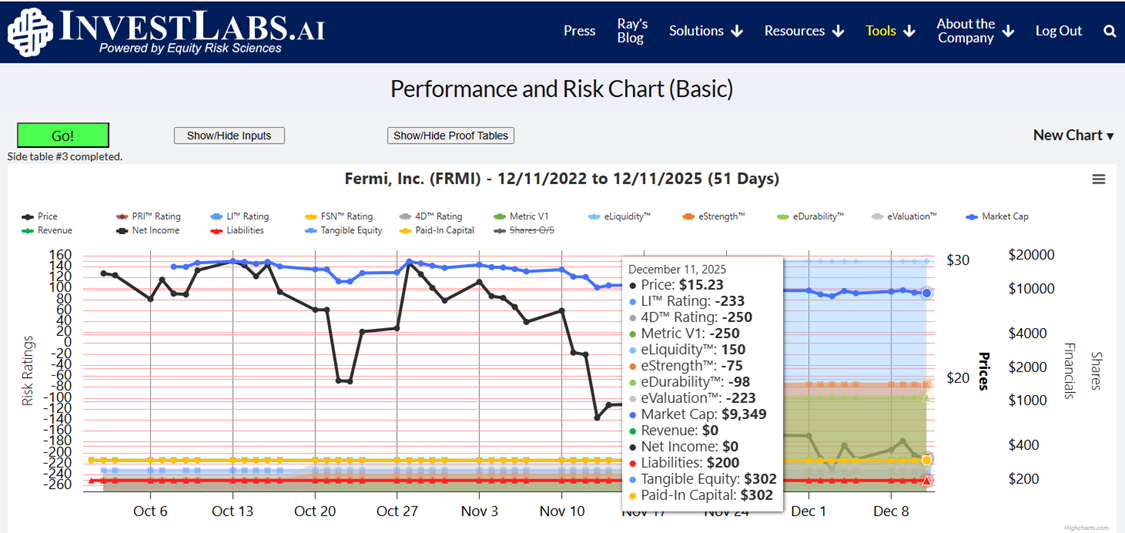

Today, 12/12/25, Fermi (FRMI)’s price fell 33%, falling from roughly $15 to $10 per share, eliminating an estimated $5 billion in market capitalization in a single session. This decline followed a prolonged period of extreme valuation despite the absence of operating revenues or earnings.

Financial Facts at the Time of Peak Valuation

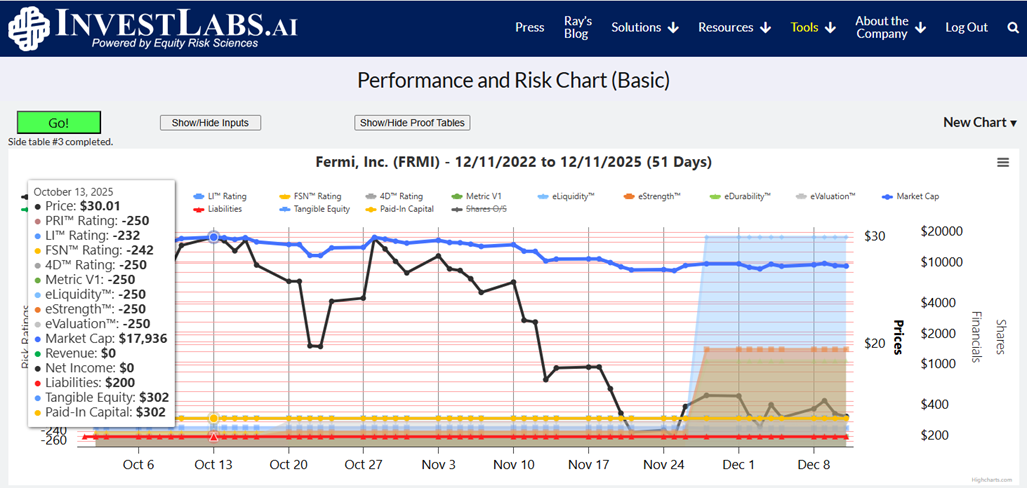

At approximately $30 per share, Fermi’s implied valuation was roughly $18 billion.

- Revenues: $0

- Net income: $0

- Cash & short-term investments: approximately $300 million

- Liabilities: approximately $200 million

- Source of cash: almost entirely from shareholder capital

Risk Definition Applied

Risk is defined as the probability and magnitude of loss. The combination of no revenues, no earnings, material liabilities, and a multi-billion-dollar market capitalization constituted an extraordinary level of downside exposure.

Fiduciary Suitability Considerations

A fiduciary is required to assess whether an investment is reasonable at the price paid. Absent revenues, earnings, or demonstrable cash-generation capacity, price becomes arbitrary and suitability difficult to substantiate.

What the ERS Ratings Demonstrated

ERS’s ratings quantified the severity of downside risk well in advance. The PRC™ showed near-maximum negative readings across valuation, financial strength, durability, and price-risk dimensions.

Structural Implications

This case illustrates how securities can achieve large valuations without reference to operating fundamentals, exposing investors to sudden and severe losses.

Key Takeaways

- Large losses can occur when valuation is untethered from financial reality

- Downside risk is measurable

- Fiduciary duty requires price-based risk assessment

- Independent risk analytics improve decision quality

Closing Note

If you’d like to learn more about ratings for your stocks, contact us today.