The 12 Essential Takeaways About ERS’s 4D™ Rating

- ERS’s 4D™ rating uses only audited SEC financial data — never opinions or forecasts.

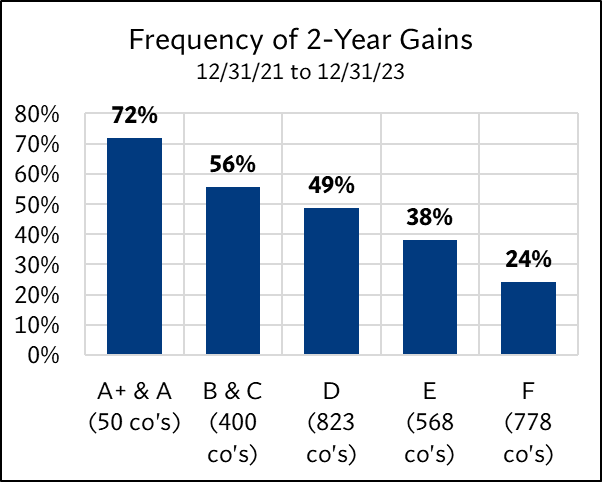

- 2,619 companies were ranked strictly by measurable financial strength and durability.

- The study shows a profound relationship between 4D ratings and future returns.

- Strong 4D-rated companies consistently and substantially outperformed the market over multiple timeframes.

- Weak 4D-rated companies experienced large, predictable, and avoidable losses.

- The 4D rating gives advisors a reliable, evidence-based method to prevent significant drawdowns.

- The 4D identifies companies with the highest probability of durable, long-term gains.

- The results represent a genuine data-science breakthrough—not a marketing claim.

- Advisors using the 4D will gain a significant, measurable competitive edge.

- 4D aligns directly with fiduciary duties to monitor, evaluate, and act on financial risk.

- Firms adopting the 4D will grow faster by reducing losses, improving outcomes, retaining existing clients and attracting bigger clients.

- This study provides the first objective, statistical foundation for distinguishing safer companies from dangerous ones—before the losses occur.

How the Study Was Constructed

The study examined the 2,619 U.S. companies on 12/31/21 with market caps above $1 billion. Each was assigned an ERS 4D rating—A+ & A through F. The forward returns for each group were then tracked over four periods: 6 months, 1 year, 2 years, and 3 years. These returns were compared to the S&P 500 to evaluate how each rating category fared relative to the broader market.